Original Research

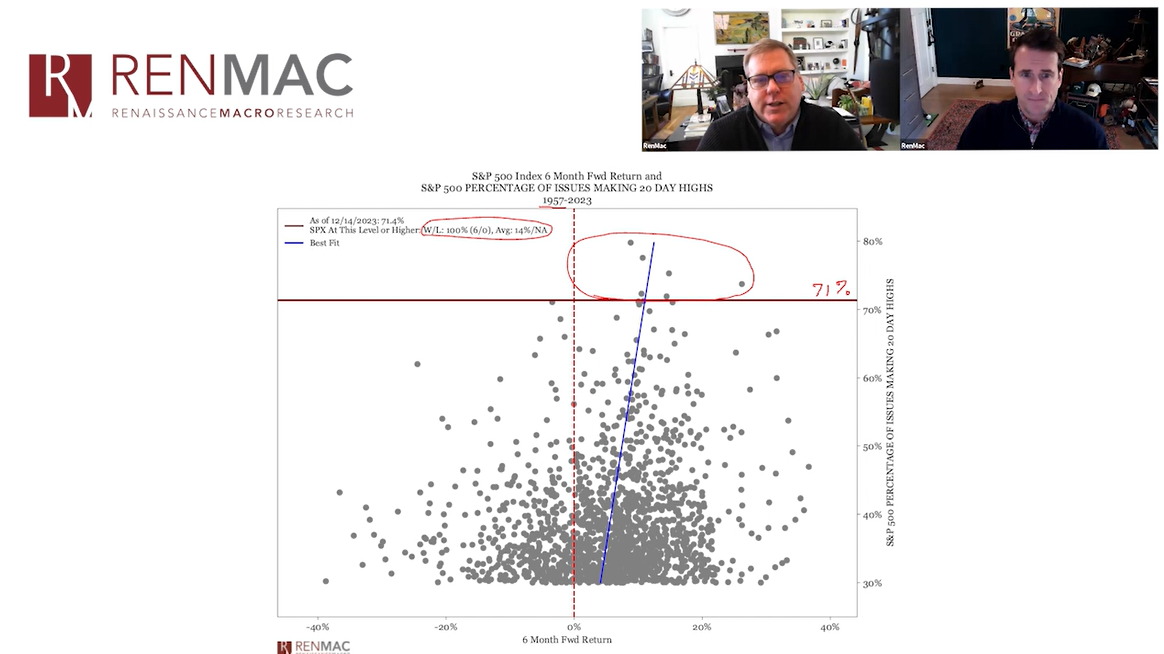

We help clients view the world through a differentiated lens not readily available from traditional investment houses. RenMac’s partners left larger bulge-brackets to focus on building a world class database back to the 1920s, writing code, and expanding our reach and intellectual horse-power into more markets and disciplines ( both strategic and quantitative) to provide some of the deepest, most original, and thoroughly vetted research on the street.

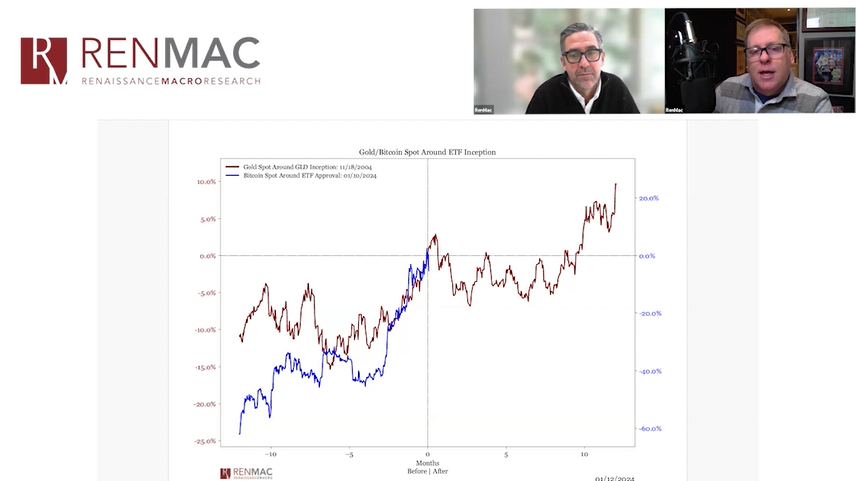

RenMac Off-Script Podcast

RenMac Asked & Answered

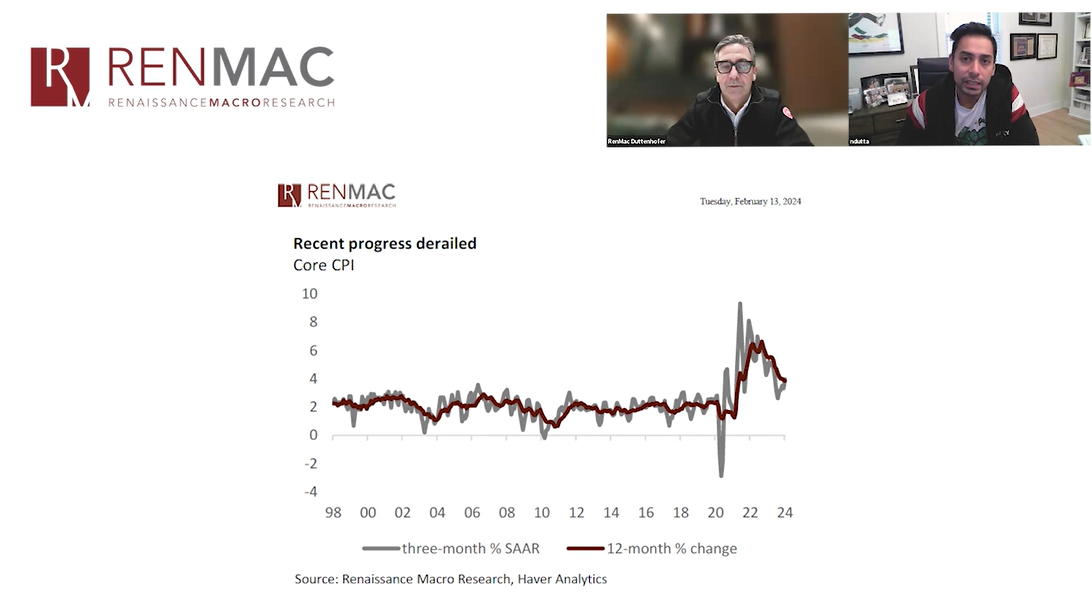

View Examples of Our Research

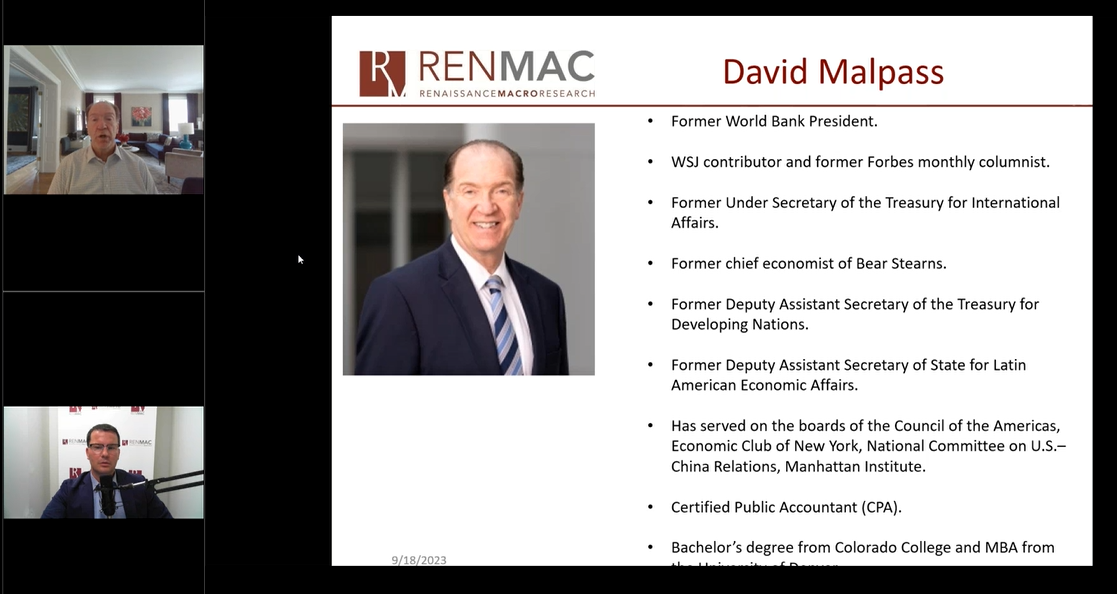

RenMac’s Management Team